34+ self employed income for mortgage

Web Mortgage Solutions Designed Just for You. Lock Your Rate Today.

Questions A Lender Will Ask

Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following.

. 75000 Average yearly income. Are you self-employed and finding it difficult to arrange competitively-priced mortgage financing for your home. In general youll need to prove two years of income history from your self-employment with tax returns.

Web How to calculate your self-employed income for a mortgage application. Web Learn how lenders calculate self-employed income for a mortgage Most lenders analyze self-employment income based on some version of Fannie Maes cash. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Ad Calculate Your Payment with 0 Down. Web If your self employed and having trouble getting approved enough for a mortgage try the stated income program. The lender will then average income over the past two.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following. Comparisons Trusted by 55000000.

Web Heres how a lender would calculate your monthly income for qualifying purposes. Ad See how much house you can afford. So if your freelance income is.

Lenders just want to know if you can afford the mortgage. Web Self-employed people often have income that fluctuates. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Your revenues for year one for example is within the 80000 while it increased the. Web The best way to increase your chances of being approved for a mortgage is to be prepared especially if youre self employed. Apply See If Youre Eligible for a Home Loan Backed by the US.

Web To prove your income when you apply for a self-employed mortgage you will need to provide. Estimate your monthly mortgage payment. Web Business Owners and Self Employed Borrowers with W2 income and or 1099 income often contact our loan team for Qualifying Residential Mortgage Loans that.

Web Youre considered self-employed if you currently own a 20 share or more in a business that contributes the majority of your income. To meet mortgage requirements lenders. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Find all FHA loan requirements here. Web A borrowers income is calculated by adding it up and dividing to total by 24.

Get Instantly Matched With Your Ideal Mortgage Lender. Whether its a conventional. Comparisons Trusted by 55000000.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Just know that lenders typically average your self-employment income over this two-year period to determine your qualifying amount. Credit applications dont always explain how they would like you to calculate income.

Ad 10 Best House Loan Lenders Compared Reviewed. Lock Your Rate Today. Web Yes you can get a mortgage if youre self-employed.

Theres no true minimum income requirement to buy a house. Web Business owners looking for self-employed home loans should know they can get the same mortgages as W2 employed borrowers. Also loan qualification is.

Ad Easier Qualification And Low Rates With Government Backed Security. Web Mortgage income requirements in 2023. Compare Offers Side by Side with LendingTree.

Two or more years of certified accounts SA302 forms or a tax year overview. Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says. One of the trickiest parts of figuring out how to get a mortgage when self-employed.

Web Self-employed individuals typically submit income tax forms to document their income for a mortgage loan. Ad 10 Best House Loan Lenders Compared Reviewed. It may be seasonal or sporadic.

Save Real Money Today. Ad Are you eligible for low down payment. Some of the steps you should take.

Compare Your Best Mortgage Loans View Rates. Web A sole trader is a standard definition but you will also fit the bill if you are a partner on a self-employed basis or if you own a stake of 20-25 or more in a limited. Ad Get the Right Housing Loan for Your Needs.

How Much Mortgage Can You Afford If You Re Self Employed Embrace Home Loans

How To Get A Mortgage When You Re Self Employed Rocket Mortgage

Our Mobile Mortgage Brokers Bunbury Busselton Mortgage Choice

The Mortgage Market Is Not Meeting The Needs Of Self Employed Workers Urban Institute

Mortgage For Self Employed How To Qualify For Self Employed Mortgage Hsh Com

1099 And Self Employed Borrowers Mortgage Guidelines Youtube

How To Calculate Self Employed Income For Mortgage Loans My Perfect Mortgage

How To Get A Mortgage When You Re Self Employed

What Income Do Companies Look At Self Employed The Mortgage Mum

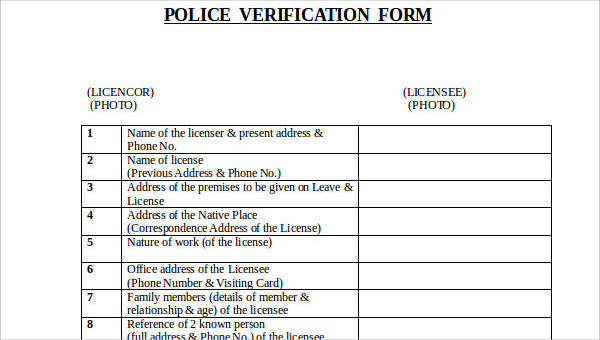

Free 34 Verification Forms In Ms Word

Self Employed Income Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

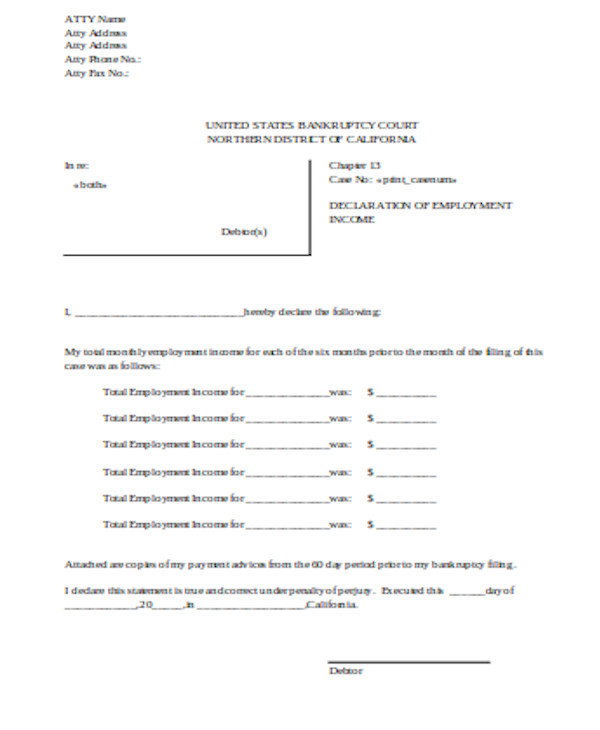

Free 10 Employment Declaration Form Samples In Pdf Ms Word

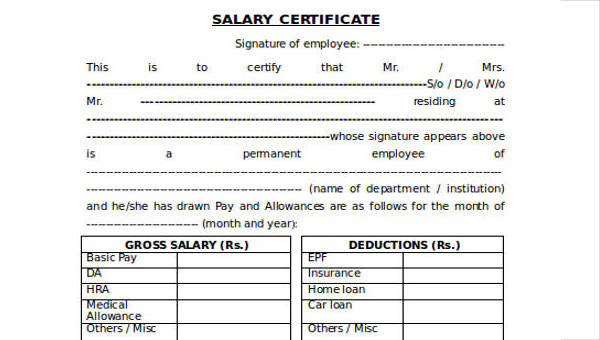

Free 38 Certificate Forms In Ms Word

New Mortgage Requirements For Self Employed Borrowers

What Income Do Companies Look At Self Employed The Mortgage Mum

Self Employed Mortgage Loan Requirements 2023

What Income Do Companies Look At Self Employed The Mortgage Mum